Copy Of Chapter 7 Discharge Papers Can Be Fun For Everyone

Table of ContentsThe 8-Second Trick For How To Get Copy Of Bankruptcy Discharge PapersCopy Of Bankruptcy Discharge Can Be Fun For EveryoneThe Only Guide for Chapter 13 Discharge PapersBankruptcy Discharge Paperwork - The Facts

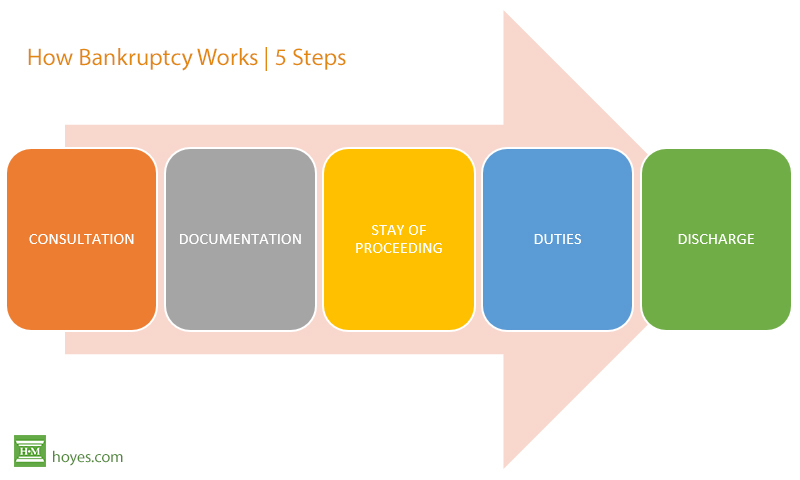

Wedded individuals must collect this information for their partner no matter whether they are submitting a joint petition, separate individual applications, or perhaps so one partner is submitting (copy of bankruptcy discharge). In a scenario where just one partner files, the earnings and also expenses of the non-filing partner are called for to ensure that the court, the trustee and also creditors can assess the house's financial position.Therefore, whether particular property is exempt as well as might be kept by the debtor is commonly a concern of state law. The debtor must consult an attorney to figure out the exceptions readily available in the state where the borrower lives. Filing a request under chapter 7 "automatically remains" (quits) most collection actions versus the borrower or the borrower's residential or commercial property (how to obtain bankruptcy discharge letter).

362. But filing the petition does not stay certain sorts of actions noted under 11 U.S.C. 362(b), and the keep might be effective only for a brief time in some circumstances. The stay occurs by procedure of legislation and requires no judicial activity. As long as the keep holds, financial institutions generally may not launch or proceed legal actions, wage garnishments, or perhaps phone conversation requiring repayments.

trustee will report to the court whether the case must be presumed to be an abuse under the means examination explained in 11 U. https://www.informationweek.com/profile.asp?piddl_userid=487827.S.C. 704(b). It is very important for the borrower to coordinate with the trustee and to supply any economic records or records that the trustee requests. The Personal bankruptcy Code needs the trustee to ask the borrower questions at the meeting of lenders to ensure that the borrower is aware of the potential effects of looking for a discharge in personal bankruptcy such as the impact on credit report, the capability to file a request under a various chapter, the impact of obtaining a discharge, and the impact of declaring a debt.

How To Obtain Bankruptcy Discharge Letter Can Be Fun For Everyone

If all the borrower's possessions are excluded or subject to valid liens, the trustee will generally file a "no property" report with the court, and there will be no distribution to unsafe financial institutions. Many phase 7 cases entailing individual borrowers are no possession instances.

A secured creditor does not need to file an evidence of claim in a chapter 7 case to preserve its safety and security interest or lien, there may be other reasons to submit a claim. A creditor in a chapter 7 instance that has a lien on the borrower's residential property need to get in touch with a lawyer for suggestions.

It contains all my link legal or equitable rate of interests of the debtor in residential or commercial property since the beginning of the case, consisting of residential property owned or held by one more person if the borrower has a rate of interest in the property. how to get copy of bankruptcy discharge papers. Usually talking, the debtor's lenders are paid from nonexempt property of the estate.

How To Get Copy Of Chapter 13 Discharge Papers - An Overview

The trustee accomplishes this by selling the debtor's building if it is cost-free and also clear of liens (as long as the building is not excluded) or if it is worth even more than any type of safety rate of interest or lien affixed to the building as well as any kind of exemption that the borrower keeps in the property.

In addition, if the borrower is a company, the personal bankruptcy court may accredit the trustee to run business for a restricted amount of time, if such procedure will certainly profit creditors and also boost the liquidation of the estate. 11 U.S.C. 721. Area 726 of the Bankruptcy Code controls the distribution of the residential or commercial property of the estate.

The debtor is only paid if all other courses of cases have actually been paid in full. Appropriately, the borrower is not specifically interested in the trustee's personality of the estate assets, except relative to the payment of those debts which for one reason or another are not dischargeable in the personal bankruptcy instance.

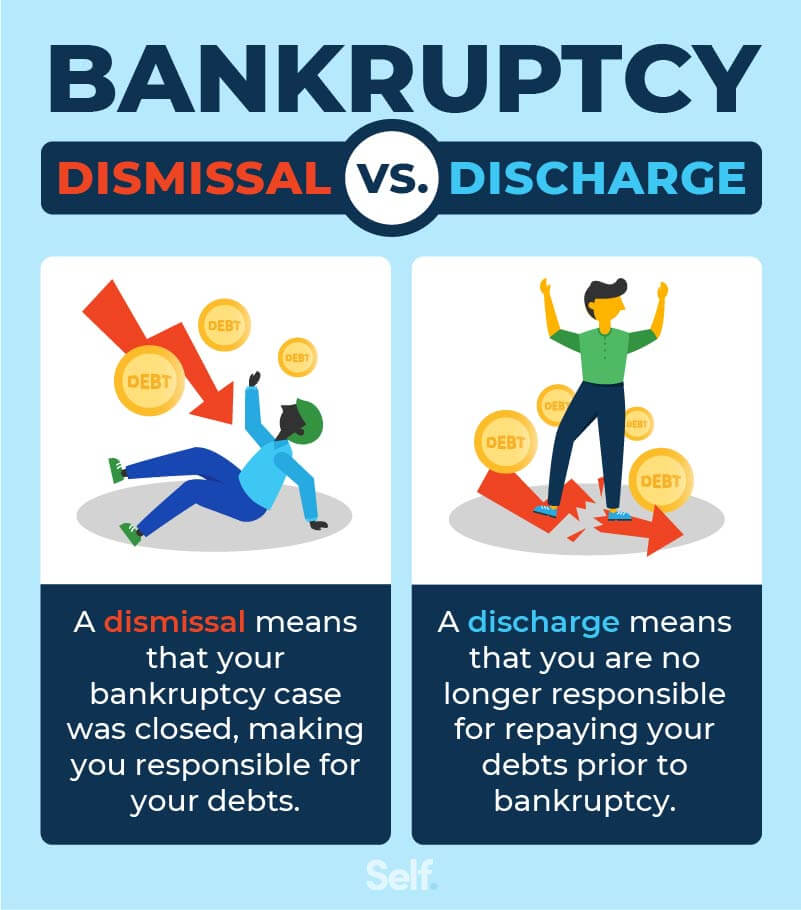

A discharge releases specific debtors from individual obligation for a lot of debts as well as stops the financial institutions owed those financial obligations from taking any kind of collection activities versus the borrower. Since a phase 7 discharge goes through numerous exceptions, borrowers should seek advice from skilled legal guidance prior to submitting to review the range of the discharge.

Not known Details About How To Get Copy Of Chapter 13 Discharge Papers

In return, the creditor promises that it will certainly not repossess or repossess the vehicle or various other residential or commercial property so long as the borrower continues to pay the financial obligation. If the debtor makes a decision to reaffirm a financial obligation, she or he need to do so prior to the discharge is entered. The borrower has to sign a created reaffirmation agreement as well as file it with the court (https://gcc.gl/I3N92).

524(c). The Personal bankruptcy Code needs that reaffirmation agreements consist of a comprehensive collection of disclosures defined in 11 U.S.C. 524(k). Among other points, the disclosures should advise the debtor of the quantity of the debt being reaffirmed and also exactly how it is computed which reaffirmation indicates that the borrower's individual liability for that debt will not be discharged in the insolvency.

A specific obtains a discharge for many of his or her financial obligations in a phase 7 insolvency situation. A lender may no much longer launch or proceed any type of legal or other action against the borrower to gather a discharged financial obligation.